SBE Council Ranks 2012 Best and Worst States for Entrepreneurship and Small Business

Pack your iPads and your enthusiasm, all you entrepreneurs--it's time to head to Sioux Falls, South Dakota.Why South Dakota? It's ranked as the #1 state to start a business in 2012, according to the Small Business and Entrepreneurship Council, who just released their Business Tax Index 2012.The SBEC maintains that taxes, whether imposed on the federal, state or local levels, are the biggest factor in economic growth and job creation.The Business Tax Index takes into account 18 different tax measures when ranking favorable locations for entrepreneurship and small business, chief of which are the state's top personal income tax rate and its top individual capital gains tax rate.According to the data, the 15 best state tax systems for small businesses in 2012 are:

Pack your iPads and your enthusiasm, all you entrepreneurs--it's time to head to Sioux Falls, South Dakota.Why South Dakota? It's ranked as the #1 state to start a business in 2012, according to the Small Business and Entrepreneurship Council, who just released their Business Tax Index 2012.The SBEC maintains that taxes, whether imposed on the federal, state or local levels, are the biggest factor in economic growth and job creation.The Business Tax Index takes into account 18 different tax measures when ranking favorable locations for entrepreneurship and small business, chief of which are the state's top personal income tax rate and its top individual capital gains tax rate.According to the data, the 15 best state tax systems for small businesses in 2012 are:

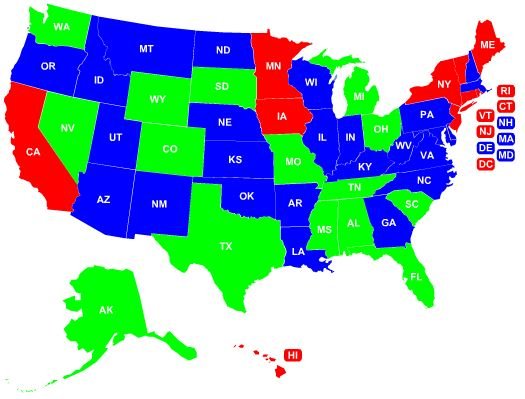

1. South Dakota2. Texas3. Nevada4. Wyoming5. Washington6. Florida7. Alaska8. Alabama9. Ohio10. Colorado11. Mississippi12. Michigan13. South Carolina14. Tennessee15. Missouri

According to the report, the 15 states with the worst tax systems for small businesses are:

37. Nebraska 38. North Carolina39. Illinois40. Oregon41. Rhode Island42. Connecticut43. Hawaii44. Vermont45. California46. Maine47. Iowa48. New York49. New Jersey50. Minnesota51. District of Columbia

38. North Carolina39. Illinois40. Oregon41. Rhode Island42. Connecticut43. Hawaii44. Vermont45. California46. Maine47. Iowa48. New York49. New Jersey50. Minnesota51. District of Columbia

If you aren't lucky enough to live in one of the top 15 states, all is not lost. The SBEC noted that states like Indiana, Arizona, Maine, Michigan, North Dakota, Delaware, and Oklahoma made positives efforts to provide tax relief in the last year.Also, while the rankings above should give you some idea of the financial challenges and legal obligations your business may face, you shouldn't let them deter you from starting a business in your home state. A business outside the top 15 can very well be successful, provided you have a solid business plan and anticipate state taxes when creating your business budget.Additionally, to cut down on your operating costs, you could take advantage of cloud services or low-cost alternatives to business infrastructure tools. Services like online fax services, hosted PBX services, and others will allow you to work virtually and reduce the need for costly hardware.Being aware of the tax rates and laws in your state (or states) of business is imperative for the fledgling entrepreneur. We highly recommend you consult with your attorney as your move forward in the startup process. To get started on your research, check out the full SBEC Business Tax Index report for 2012, which offers additional state rankings on relevant business factors like state property taxes, state and local sales taxes, gas and diesel taxes, and wireless taxes.